Billions for future fashion brands

Who will be the largest and most influential player in the fashion industry? If you immediately thought of Chanel, Armani, Prada, Dior, Burberry or other high-end brands, or retailers such as H&M or Zara, then it is clear that you are out of the online fashion loop.

Downtrend case

You should find similar story in all countries in which companies pay too little attention to online. The fact is that the internet is an ever-shifting market and trends are bound to turn around eventually; in fact, in the past weeks my discussion partners from the Slovenian fashion industry tried to convince me that lately customers are increasingly seeking out brick and mortar stores. They supported this claim with the fact that the online store Stilago recently shut down after five years of operations, and that from 10 July Fashion Days will also terminate its presence in Slovenia due to some undisclosed business changes. Being the indefatigable online sales promoter that I am, I am concerned by such a turn of events, because this will lead to a temporary standstill of the fashion offering on Slovenian internet sites.

The big players apparently don’t get it. Sportina Bled, which in 2009 generated sales of 77 million euro and once spearheaded the clothing retail industry in the country, generated sales of only 40 million euro in 2014. Instead, the top position went to Magistrat International (Galerija Emporium owner) which has seen a gradual decline of sales from 2011, too. (the 2014 figures have not yet been published). However, since the people of Slovenia still wear clothes while going about their daily business, it is clear that a shopping shift must have taken place: they now shop at online retailers from abroad. I do not think it is good idea to sit around, waiting for the tide to turn and for the customers to return to conventional stores.

Global growth

There are three notable European companies competing on the global fashion market: First there is the Germany-based Rocket Internet Group, the second is the British Asos and the third the Italy-based Yoox which has just recently acquired the fourth competitor Net-A-Porter. It looks like in 2016 they will be joined by Style.com, which is currently a website featuring fashion photography and fashion articles, and owned by the Conde Nast company which publishes the famous Vogue – not exactly a fashion rookie, right?

These online retailers reported that their sales figures have skyrocketed and apparently none of them have problems coming up with the capital necessary for the fast growth which is required to win this race.

On its website, Rocket Internet boldly declares that it sets out to become the largest global online platform outside the USA and China. The proof that this statement is more than just wishful thinking is their spin-off company Zalando – the largest fashion item retailer in Europe. In 2014 Zalando recorded a jump from 1.7 billion euro to 2.2 billion euro, for the first time wrapping up the business year with a healthy profit of 47 million euro. The company began its sales operations in 2008 in Germany, and currently runs subsidiaries in 13 European countries, its total worth valued at 7.7 billion euro. Rocket Internet is the lead shareholder in the Global Fashion Group which recently announced that it secured 150 million euro in new funding to purchase the Brazilian online retailers Kanui and Tricae.

Yoox too is aware that there is a market to be conquered beyond Europe. After acquiring Net-a-Porter, the company expects large growth in China which is said to become one of their top ten markets already this year. In 2014, 24 million visitors per month generated sales in the amount of 1.3 billion euro. Combining fashion and technology, the retail giant is valued at 1.8 billion euro which is not much considering that Yoox and Net-a-Porter were among the first online fashion stores around.

But I guess there is more to it than just business results. In 2014, Asos generated a little less than 1 billion euro in sales, driving its value to around 7 billion at the beginning of this year. Later it dropped to 3 billion and currently stands at 4 billion euro. Last year the growing strength of the British pound made Asos less competitive on the Russian and Australian market. This led to a drop in sales and lower prices in turn affected the sales performance. Even though online retailer Asos boasts of cultivating shoppers with high customer loyalty, the company quickly realized that the modern shopper is not prepared to choose loyalty over price.

Making room for new players

There is a large gap in online fashion which should be filled by start-up companies from all regions.

Styliff, a young company (for the time being still mostly Slovenian owned), designed an app for trying on garments found online before committing to a real purchase. More specifically: you can dress one of the photos that you previously saved on your smartphone in the desired garment. Naturally, you can share your experience with your friends, ask for their opinion and commit to a purchase only when you are absolutely sure that this is the outfit for you. But watch out – according to the first results shoppers buy and spend more when using this app! This new way of shopping for clothes therefore appeals to online retailers and has made the Styliff team feel more than welcome in retailers’ offices. Their brand offer now includes clothes by MaxMara, Diesel, Boss, Ralph Lauren, Moschino, DKNY, Alexander Wang and others. They are among the most successful and most observed companies in ABC Accelerator Smart Cities program with estimated value 3 to 4 million euros.

Another innovative way of shopping was showcased by Trillenium . A combination of virtual reality, computer games, mobile technology and 3D technology resulted in a virtual store where you don’t browse but instead walk around the online store, choosing items that catch your fancy. Immediately recognising the company’s potential, Asos pledged funds and commissioned the first virtual stores. This is a big step forward for the e-tailer without a single brick and mortar store. And perhaps this concept will be their competitive edge. Enough for Trillenium estimated value 3 million euros.

Now, who are you going to wear tomorrow?

When Food Waste Turns into a Global Business

When, a few months ago, I heard SmartFuturistic speak for the very first time, story immediately appealed to me. Too much food is being thrown away, and if this can be reduced, however slightly, using a mobile phone application (these are, after all, the only applications that are made nowadays), it is worth listening to the idea and, if need be, help out. Can it be turned into a business? Perhaps.

Instead of complaining about the fact that some sellers and producers waste up to 30% of food left on their shelves, SmartFuturistic thought about what they knew and what they could do to solve the problem. The solution is the smartFuturistic application that helps producers and retailers sell their stock. The closer the “best before” date, the harder it is to sell. And all that is left when the date expires is the cost of discarding the food.

This is where SmartFuturistic comes in: the new application allows producers to extend the time of sale, thereby reducing the possibility of having to throw the food away. The algorithm helps sellers find the appropriate buyers and, in the event of reaching a deal, the most appropriate means of transport. Though the application was initially meant to be a shortcut to selling to larger clients, such as schools, kindergartens, hospitals, hotels, zoos and similar enterprises and organisations, it quickly became apparent that the solution also establishes connections between sellers and buyers over greater distances. Using SmartFuturistic, a German company can, for instance, sell its excess beer to China.

At this point, everything goes into overdrive. The SmartFuturistic team becomes one of the first eight companies to receive funding from the business ABC Accelerator, develops at a blistering pace over a period of three months and draws the attention of a large number of international investors on the presentation day. Not even a fortnight later, they come in second at the TechCrunch start-up competition (more on http://techcrunch.com/2015/07/13/budapestcrunch-ii-was-a-great-success) in Budapest.

Thanks to their extensive know-how and excellent solution, the future is wide open for the enthusiastic, well-organised team of SmartFuturistic. Anyone thinking of making it in the business world would do well to remember that SmartFuturistic’s solution is coming on the market at the right time. (Timing is important!) Well, maybe a second too early, just enough to get ahead of the competition. Which never hurt anyone. But the fact is that the world wants and needs this solution. It does not need convincing. The United Nations have adopted a plan to cut food waste by half by 2030, thereby reducing the number of starving people around the world. A few weeks ago, France passed a law prohibiting supermarkets from throwing away food that is past its “best-before” date. But that is only part of the problem. A large portion of food rots in the fields. I am glad that this issue has become a topic of discussion among European politicians, with similar laws being drafted in other EU Members states as well. I am even more glad, however, that SmartFuturistic and their investors have recognised this as a business opportunity. That is the best guarantee for reducing food waste.

What matters most in selling online?

At Amazon.com you can buy just about anything. Still, it is public secret t that 80% of their sales are generated from products that are sold exclusively at Amazon. Never mind the fact that the company is the leading online retailer boasting the largest customer base, a quick website featuring detailed descriptions and contents, an excellent user interface and so on. Just look at the prices of any of the technical products and you will get the picture. It’s the price. The main obstacle is the high price.

Being the only provider of a certain item and offering your products only at a website such as Amazon.com, you can achieve great sales results. Having come to the same conclusion, many Americans and other vendors rely on just one website such as Alibaba.com, eBay.com or Amazon.com or, alternatively, just a handful of online stores to sell their products.

Do you want to know why this is a good thing?

Manufacturers who dominate classic sales channels have an interest that their products take up as much of the sales’ area in as many stores as possible. Some opt for a smaller number of intermediaries who meet certain criteria to assist them in this process, but regardless whether they decide to set up an intensive or selective sales’ path, they are always on the lookout for more intermediaries. In certain fields exclusivity is rare. Buyers are looking for providers offering the best deals, but retailers can maintain different prices on account of their personal approach and special bonuses without being in direct competition with each other, even though they are only a block or two apart.

The internet on the other hand is a very different animal. The internet is about transparency; it is also about a unique mix of indirect and direct sales. It’s a whole new model. The manufacturer or provider can offer their product or service directly to the shopper, albeit indirectly via an online service such as Amazon.com or enaA.com, but this does not diminish the fact that this is a direct selling technique. More often than not, products are delivered from the manufacturer’s warehouse. That makes sense – it’s practical, quick and cheap. The warranty and after-sales customer support have to be provided by the manufacturer and its servicing network. Ultimately, the product price is also determined by the manufacturer itself. In short, the online retailer is an intermediary, whose role is much smaller than in classic sales, giving the impression that the shopper and the manufacturer communicate without any intermediary at all.

Why I advise against copying classic sales’ paths and applying them online?

Manufacturers who go down this path and offer their products in countless online stores are faced with the issue of price management. Online stores are not several miles apart, but only a few clicks. Shoppers can thus easily find stores that offer the same product for a lower price. And distance doesn’t matter; the store can even be abroad.

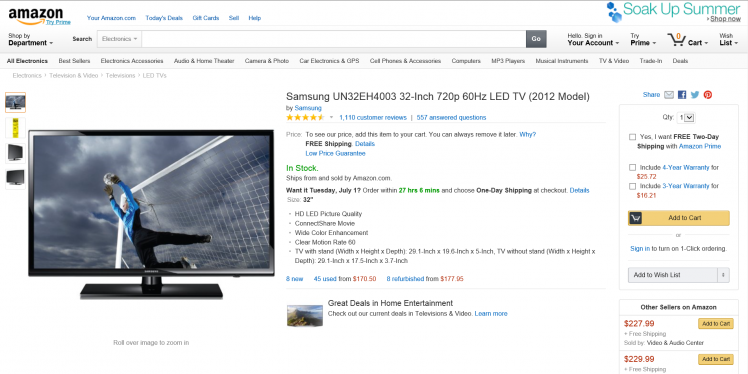

Now let us take a look how this works in practice. The Samsung UN32EH4003 television set is listed at Amazon.com without a price. Instead, it says “To see our price, add this item to your cart.” The shopper can only see the price after adding the product to the cart where it says that their price is lower than Samsung’s recommended retail price, so Samsung does not want it to be public.

If you think that the two retail giants Amazon and Samsung have adopted a successful sales model and that this approach is a good idea, I suggest googling “UN32EH4003”. You will get hits for this TV at samsung.com, amazon.com, digitaltrends.com, walmart.com, bestbuy.com, cnet.com, ebay.com, electronicexpress.com and conns.com. Each site displays a different price. Samsung doesn’t control anything; it just limits sales via online retailers who are big enough to be controlled.

Which one of these platforms will end up selling the TV? The one with the fastest and more flexible service, and with the lowest price point. This is why you will not find this TV among the bestsellers at Amazon.com.

Similarly, Google doesn’t favour the offerings of the same product at various websites with an identical photo and descriptions. For the browser, this is just a copy of one and the same site, and is therefore punished by a lower rating. If someone looks up LCD TVs, those pages will not be among the top hits, I am sure of it. Now you have another reason why it is better to be the direct retailer online.

However, even though Samsung and other similar retailers did not adapt to the new situation, smaller American business saw their chance in selling their products and services exclusively via Amazon – with great results.

Example from Slovenia, Europe: enaA.com offers you the Samsung 32H4000 with the lowest price guarantee.

Banks are losing the payment transaction business

In a few years, payment transactions and trade will be completely different from what we are used to.

If you are not buying things online and are not aware of the unbelievable growth of online sales, or if paying with PayPal still seems like a novelty to you, then you are behind the times. You probably do not know that there are new online retail companies providing services which attract more and more payment transactions. Will you continue to read if I promise to list three new European service providers whose individual worth exceeds EUR 1 billion?

The breathtaking growth of areas including online sales, cloud technology and the standardisation of devices (which allows virtually the same software to run applications on smart phones, tablets, computers, POS terminals and other devices) has enabled new service providers to enter the market as soon as they spot an opportunity. This time we are not talking about the sort of enthusiast that the market has a hard time understanding and accepting. We are talking about unicorns. I am not being romantic – this is the actual name given to start-ups who quickly achieve a worth of EUR 1 billion or more. Their businesses are shamelessly large, but even so, in Europe we have at least three unicorns in this sector alone.

Doubling the Volume of Business Each Year

Adyen (www.adyen.com) provides a seamless solution for mobile, online and in-store transactions, which enables merchants to accept almost any type of payment anywhere in the world. The solution is used in the largest stores and kiosks as well. Having received a financial injection worth USD 250 million from General Atlantic, Index Ventures and Felicis Ventures in December 2014, the company’s worth has been assessed around EUR 1.4 billion.

Its Dutch founders, Pieter van der Does and Arnout Schuijff, like to emphasise that as of yet they are not considering selling their company. And why would they? They double the volume of their business each year. At the moment, the company operates in 187 countries and their services are used by 3,500 global service providers, including Facebook, Burberry and Spotify. They can wait a few more years and then retire with EUR 30–50 billion in their pockets.

A Business Larger than Alibaba

Powa (www.powa.com) is a British unicorn. In June 2014, the company bought their smaller competitor, the Hong Kong-based MPayMe, for USD 75 million and expanded their services in the field of mobile payments. Although the purchase price amounted to the company’s sales over 2.5 years, it has proven to be a worthwhile investment. Today, Powa is worth around EUR 2.5 billion. Dan Wagner likes to boast that his business is larger than Alibaba.

Powa combines mobile payment services with online commerce services. PowaWeb provides cloud-based commerce services. PowaPOS is an application that transforms a tablet or smart phone into a cash register. PowaTag provides a new payment solution which is used by more than 1,100 service providers worldwide. All of these services operate online, offline and in physical shops – from the smallest boutiques to the largest shopping centres.

Banks Cannot Compete

Owners of Skrill (www.skrill.com) were less patient and sold the company to the London-based Optimal Payments for “a mere” EUR 1.1 billion. Skrill is in charge of payment transactions on eBay, Bet365 and Skype. In contrast to its competitors, Powa and Adyen, the company also provides money transfer for their users and operates in other fields where there are plenty of other unicorns.

If I reveal that Powa employs only 500 people, it becomes clear that banks simply cannot compete with the new services provided by these companies – companies which bring a new approach, quality and, above all, lower costs. In a few years, payment transactions and trade will be completely different from what we are used to.